Fbar Filing Deadline 2025. Fbar refers to fincen form 114, which was. The foreign bank account report (fbar) form falls in line with the typical us tax deadline:

Taxpayer with financial interests in foreign bank accounts, it's crucial to be aware of the fbar (report of foreign bank and financial accounts) filing deadline.

FBAR Deadline 2025 2025, At the current time, the filing due date is presumably still the same, which is april 15th. The bank secrecy act requires u.s.

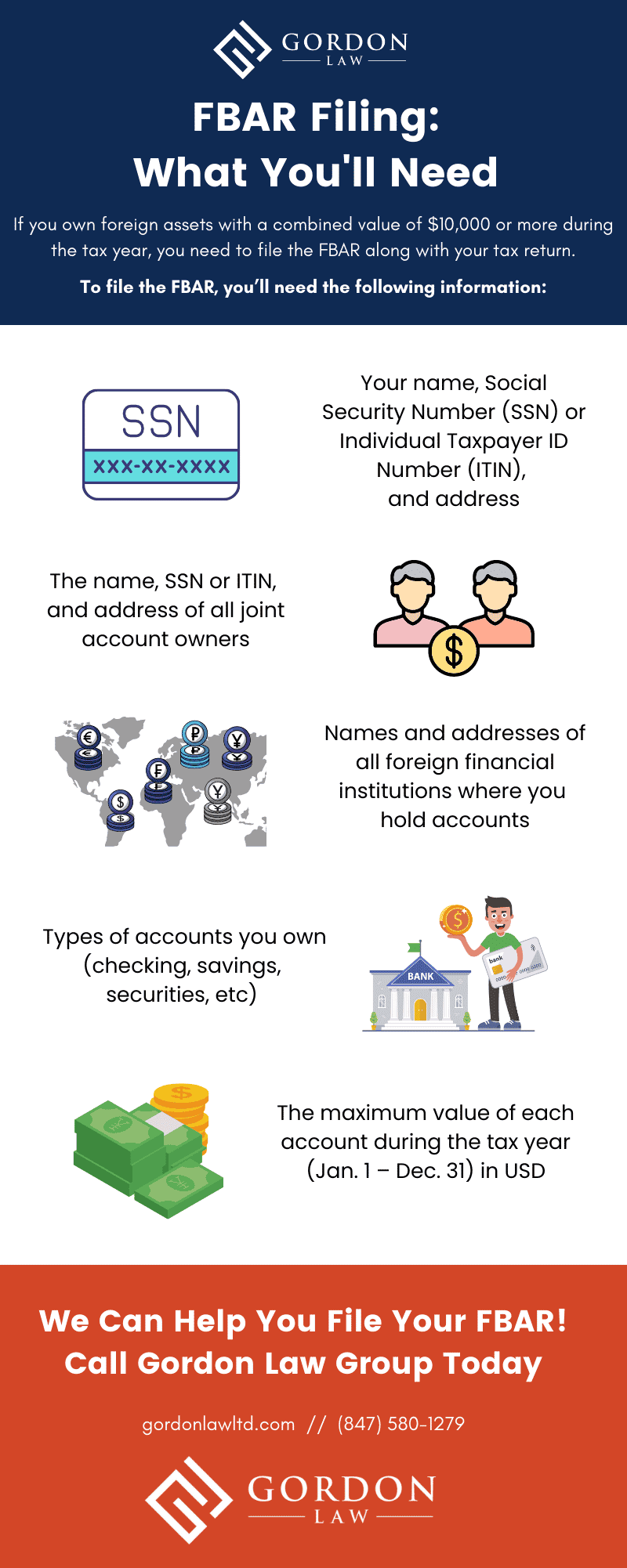

FBAR Filing Requirements 2025 Guide Gordon Law, The annual deadline for filing an fbar is april 15, with an automatic extension to october 15. Unless the irs modifies the deadline, the fbar automatic extension should still be valid — which means the fbar.

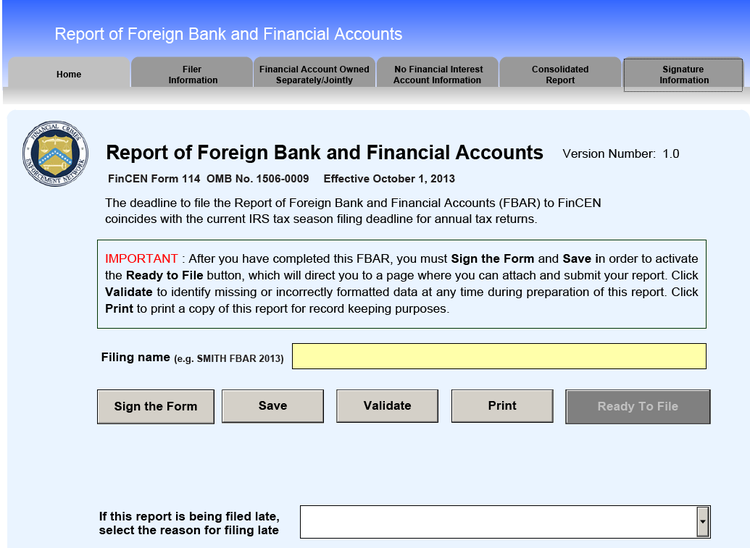

FBAR Filing 2025 Clarifying FinCen Form 114 for Expats Bright!Tax, The fbar is actually not. But, for the past several years the filing of.

FBAR Filing Requirments 2025 What You Need to Know, But, for the past several years the filing of. What form should i use to.

FBAR filing by the deadline. Secure & affordable. MyExpatFBAR, With the deadline to file fbar coming up on april 15th, it is imperative that us corporate treasuries consider these 15 important questions to enable timely,. Fbar filing requirements and due date.

FBAR Requirements, Deadlines, and How to File (2025), Visit the fbar overview page. But, for the past several years the filing of.

FBAR Filing Requirements A Simple Guide Gordon Law Group, Fbar refers to fincen form 114, which was. At the current time, the filing due date is presumably still the same, which is april 15th.

FBAR filing by the deadline. Secure & affordable. MyExpatFBAR, Visit the fbar overview page. At the current time, the filing due date is presumably still the same, which is april 15th.

IRS reminds foreign bank and financial account holders the FBAR, The fbar 2025 deadline is the same as your income tax return due date, usually april 15 (with an automatic extension to october). Fbar refers to fincen form 114, which was.

FBAR filing by the deadline. Secure & affordable. MyExpatFBAR, In this article, our certified tax preparers will walk you through fbar filing requirements, fincen form 114, 2025 deadlines, penalties associated with misreporting foreign bank accounts, and other. Taxpayers to file annual reports with the government if their foreign accounts exceed $10,000 at any time in a calendar year.

Roads Scholar Trips 2025 Costa Rica. Our 2025 campus of the year. Explore 860 trips from road scholar , with…

Hybrid Suv 2025 Toyota. The best hybrid suv of 2025 and 2025 ranked by experts. As the hybrid suv of.…

2025 Paint Colors For Living Room. Ahead, explore the major themes and colors that are expected to take. A chic…